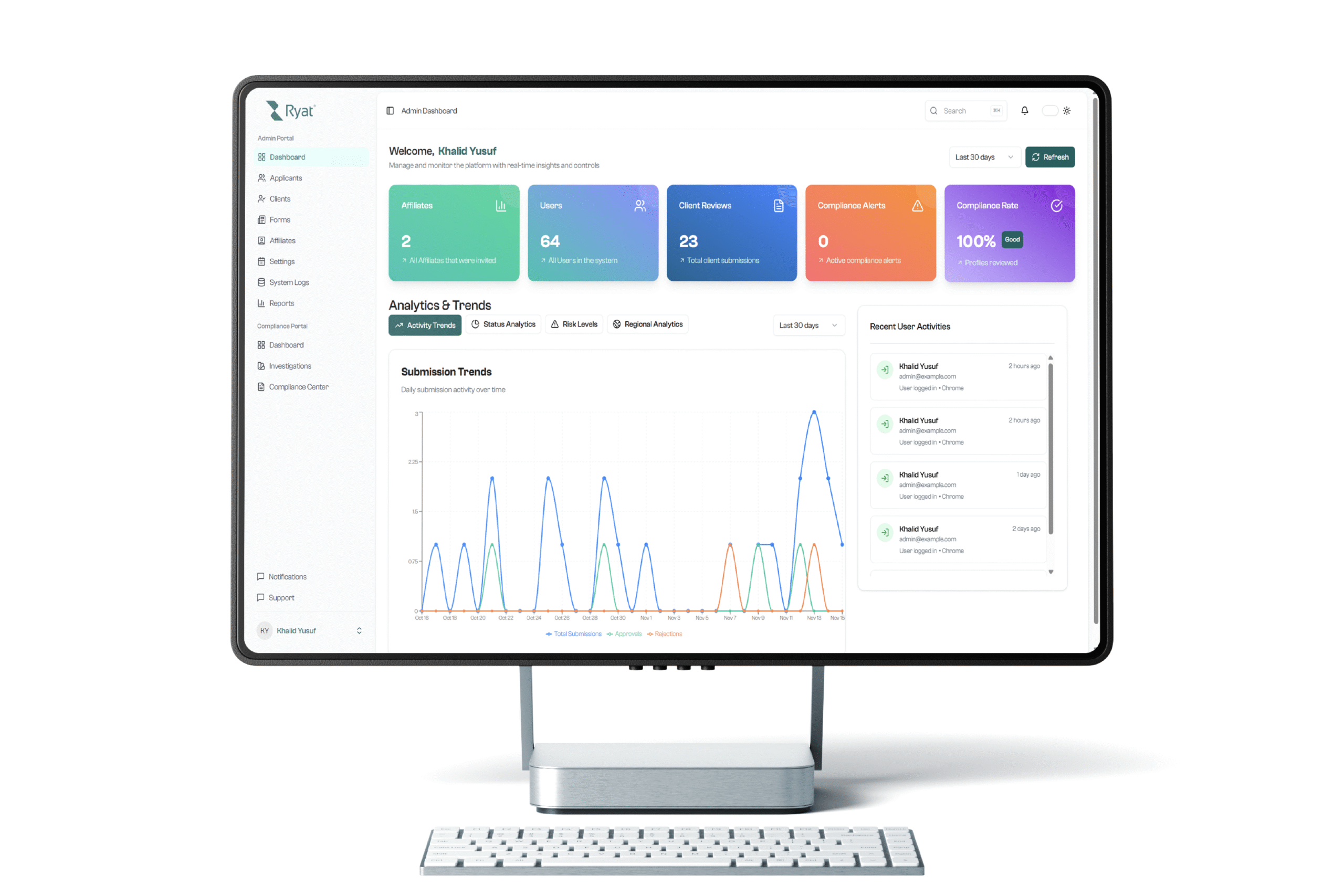

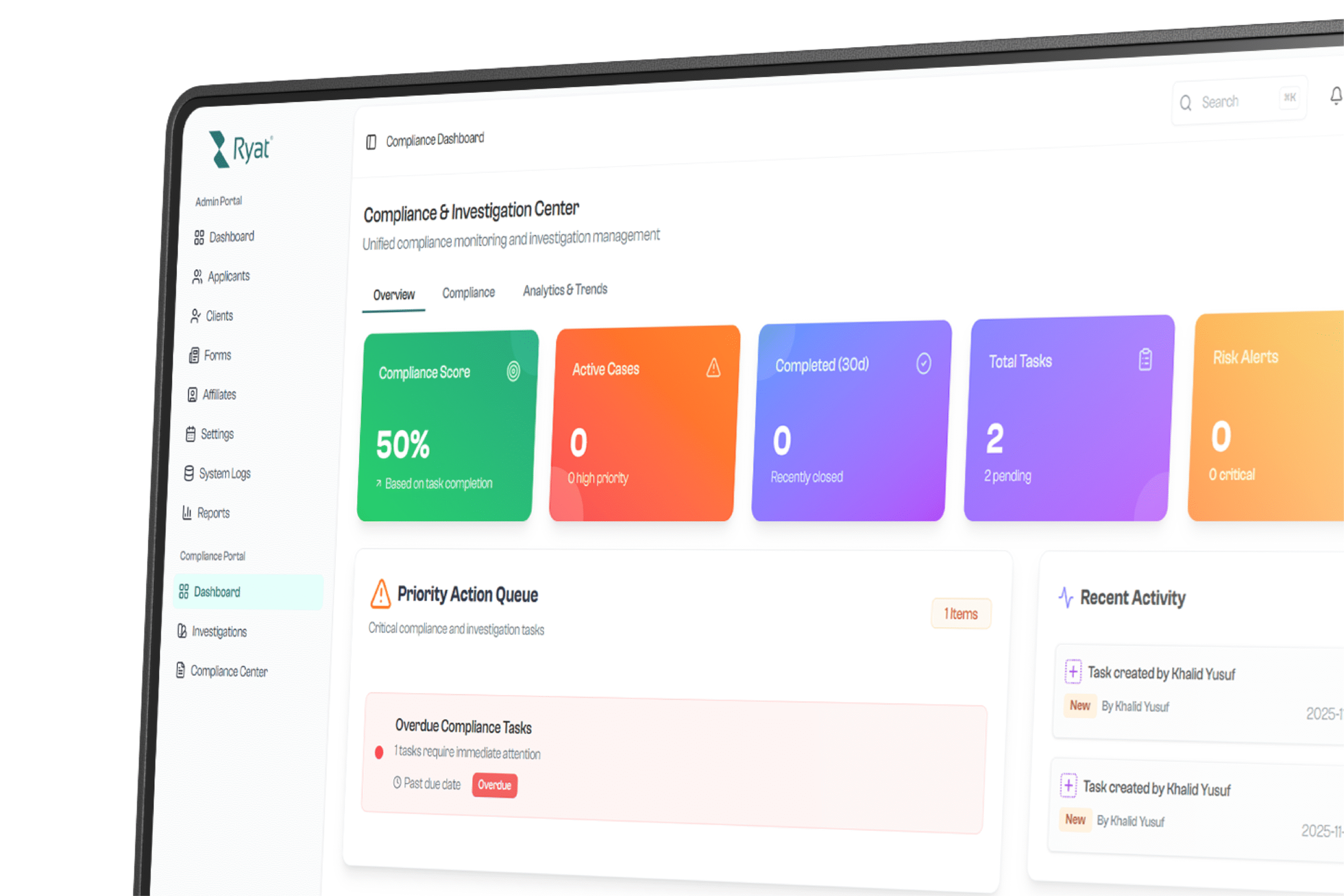

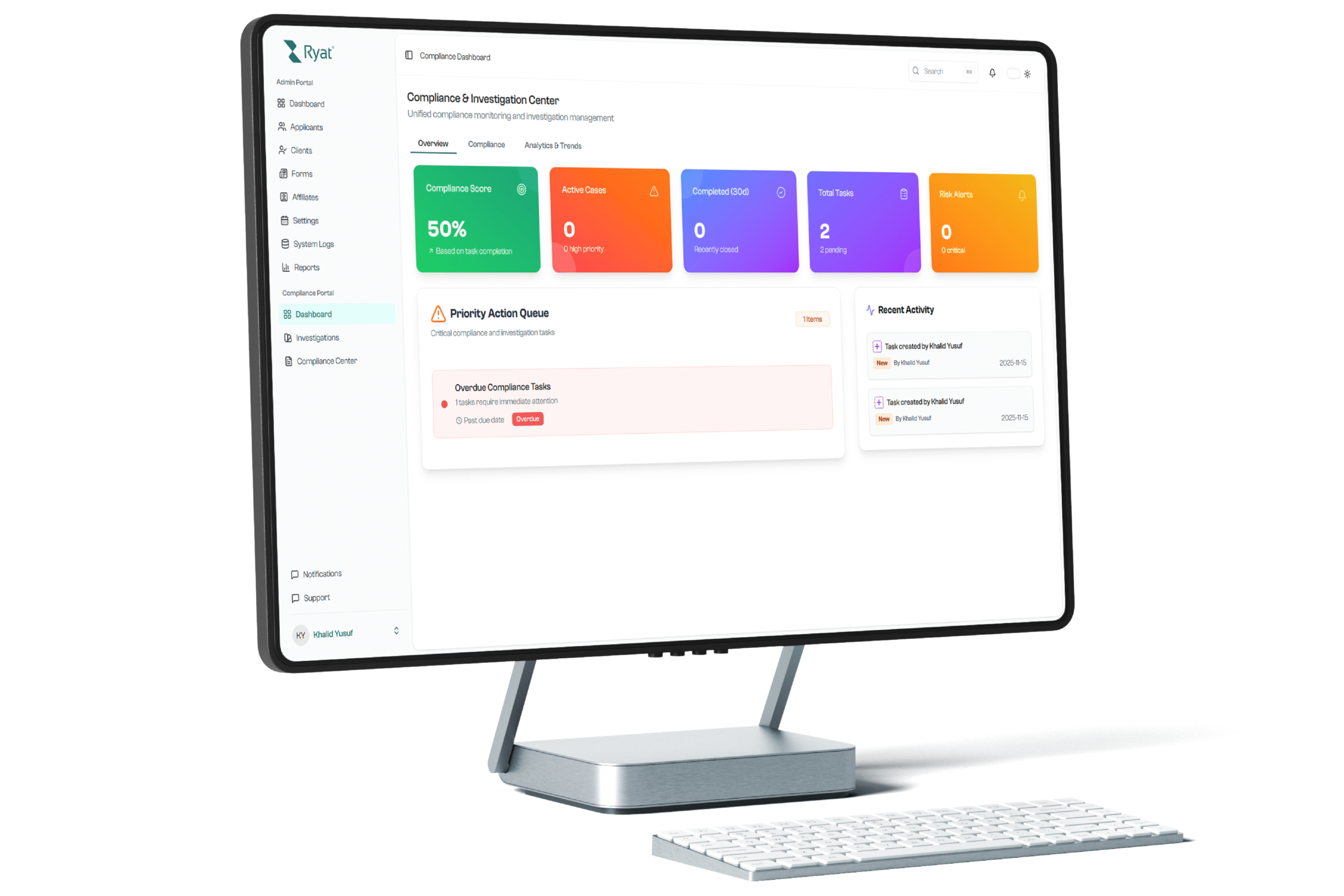

Ryat Compliance Platform

1. System Name and Purpose

The system is called the Ryat Compliance Platform.

Its overall purpose is to build trust from the very first interaction and make compliance automatic rather than a chore.

It simplifies the process of client and provider onboarding and compliance.

It is designed for companies and organizations that need to onboard clients and providers and manage regulatory requirements.

2. Problem It Solves

The Compliance Platform addresses the problem that client and provider onboarding can be slow and stressful due to tightening regulations.

It solves this by integrating AML, KYC, and sanctions checks directly into the onboarding process, making compliance automatic.

It differs from existing solutions by embedding compliance into the process itself, which helps companies onboard faster and avoid penalties.

This approach turns compliance into a competitive advantage.

3. How It Works

The system operates by integrating AML (Anti-Money Laundering), KYC (Know Your Customer), and sanctions checks directly into the user's onboarding workflow.

It automates risk scoring to stop issues before they start.

It also collects licenses, tax documents, and regulatory details for providers in one place.

The platform supports tailored workflows for different entity types like Businesses, corporates, SMEs, and banks.

It includes Real-Time Alerts for instant compliance issue notifications and detailed, export-ready Audit Trails for regulators.

The nature of the tailored workflows and document collection suggests a web-based software platform.

4. User Benefits

The main benefits are:

• Onboard faster

• Stay compliant and avoid penalties

• Save time and cut risk

• Build trust with clients from day one

• Turn compliance into a competitive advantage

5. Key Features

The most important features are:

Integrated Compliance Checks:

Includes AML, KYC, and sanctions checks.

Provider Registration

Instantly views balances across all vaults in USD equivalent.

Client Onboarding

Supports tailored workflows for Businesses, corporates, SMEs, and banks.

Risk Ratings & Exposure Limits

Automates risk scoring.

Real-Time Alerts

Instantly informs about compliance issues

Audit Trails: Every step is logged and export-ready for regulators.

Automates risk scoring.