Ryat Payments

1. System Name and Purpose

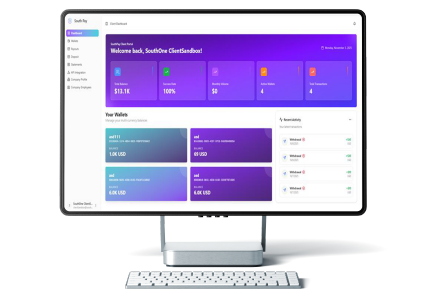

The system is called Ryat Payments (API Payouts).

Its overall purpose is to handle settlements, conversions, and payouts with precision and speed, ultimately enabling faster settlements and smarter conversions for business growth.

It is designed for businesses that require a payments engine for settlements, conversions, and payouts.

2. Problem It Solves

Ryat Payments addresses the need for a streamlined, integrated payments engine capable of handling global scale.

It solves the problems of operational bottlenecks and a lack of visibility into money location.

Its key difference is being API-ready, allowing businesses to instantly plug it into their existing workflows.

This single API connection enables settling in multiple currencies and reduces operational friction.

3. How It Works

The system operates by connecting seamlessly to a business's infrastructure via its API Layer.

This layer allows for:

• Triggering settlements (POST /payouts)

• Automating conversions (POST /conversions)

• Tracking progress (GET /status/{id})

It facilitates the creation of client or provider settlements (incoming or outgoing) linked to trades or deals.

It automates conversions of foreign exchange (FX) with instant calculation of spot or agreed rates, fees, and taxes.

It includes built-in security via API keys and compliance checks, and handles reconciliation by linking directly to the chart of accounts.

The core functionality is based on an API (Application Programming Interface), making it an integration-focused software layer.

4. User Benefits

The main benefits are:

• Ease of scaling globally

• Ability to settle in multiple currencies with one API connection

• Reduced operational bottlenecks

• Always knowing where the money is

• Faster and smarter handling of settlements and conversions

5. Key Features

The most important features are:

Settlements

Creates linked client or provider settlements (incoming/outgoing).

Conversions

Automates FX with instant fee and tax calculation.

API Layer

Provides endpoints for triggering settlements and conversions, and tracking status.

Reconciliation

Linked directly to the chart of accounts.

Security

Built-in API keys and compliance checks.